Investment Advisory

Investment Advisory

As we close the chapter on 2024, it’s clear that the year brought a unique mix of opportunities and challenges across investment landscapes. Equity markets demonstrated contrasting dynamics across segments and themes, with microcaps and select thematic sectors leading the way. Fixed income benefitted from cooling inflation and rate-cut anticipation, while precious metals like gold shone brightly amid geopolitical and economic uncertainties. In this retrospective, we unpack the performance of key asset classes, sectors, and factors, offering insights into how they shaped portfolios and what this means for the journey ahead. This 2024 market analysis highlights the evolving trends that guided investor strategies throughout the year.

In 2024, market performance exhibited distinct patterns across different segments and themes, with smaller market caps and specific sectors/themes performing notably well. Valuation expansion in these segments has resulted in a significant premium to their long-term averages. Earnings trajectory going forward will be crucial in determining the extent of vulnerability built into valuations. Flows were robust in growth-oriented opportunities and thematic sectors while larger, more stable segments faced challenges.

Microcap stocks led the way, showing strong returns despite their volatility, reflecting investor confidence in smaller, high-growth companies. Small-cap stocks also continued their positive momentum, benefiting from a focus on growth investments. The Nifty Next 50, a transition index to the Nifty 50, also performed well, driven by broader market strength. In contrast, large-cap indices like the Nifty 50 lagged, indicating a preference toward smaller, more dynamic market opportunities in 2024. The year also saw an interesting shift when it came to small cap vs large cap performance, with small-cap stocks outperforming large-cap counterparts in terms of growth potential and investor interest.

Thematic Sectors: Several thematic sectors stood out:

Capital Markets thrived due to increased investor activity, including IPOs and mutual funds.The capital market growth seen in 2024 highlighted a positive trend for investor engagement and confidence across various segments.

Defence saw strong demand driven by indigenization and rising defense spending.

Digital Technology continued its growth, fuelled by widespread digital transformation and substantial investments in tech by businesses and governments.

CPSE ETF: The CPSE ETF, tracking public sector enterprises, performed well for most of the year but experienced a significant drawdown after October due to market volatility. Despite this setback, it remained a solid performer.

Commodities and Energy: The commodities and energy sectors faced difficulties due to weak global demand and fluctuating raw material prices. Energy companies, particularly in oil and gas, struggled impacting their performance.

Healthcare and Pharmaceuticals were strong performers, benefiting from consistent demand and robust earnings.

The IT sector also performed well, driven by expectations of demand revival, growth in cloud services, and focus on cybersecurity solutions.

Consumer Durables showed strength as discretionary spending rebounded post-pandemic. In contrast, Media, FMCG, and Private Banks underperformed. The Media sector struggled with reduced advertising spend, FMCG faced inflationary pressures, and private banks were impacted by slower loan growth and concerns over possible asset quality issues.

Nifty Alpha, Midcap Momentum, and small cap Quality stocks emerged as top performers, benefiting from strong flows.

Conversely, High Beta stocks underperformed due to fluctuating investor risk sentiment. Similarly, Nifty 100 Low Volatility stocks struggled, as market conditions favoured higher-growth, dynamic assets over stable, low-volatility investments.

Quality, Value and Low-Volatility in general underperformed when compared to Alpha and Momentum

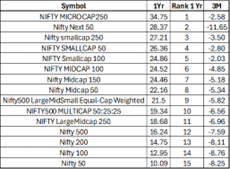

Broad based Index:

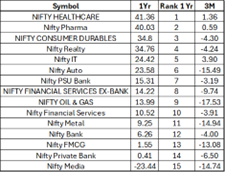

Sectoral Index:

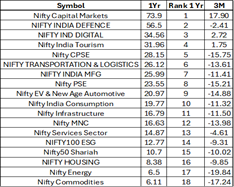

Thematic Index:

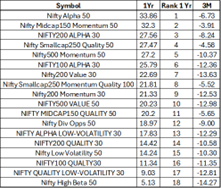

Factor-based Index:

Source: NSE

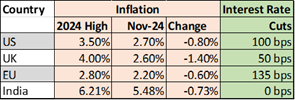

With inflation cooling off (refer to the table below) supported by mixed growth numbers, central banks worldwide initiated the expected rate-cut cycle. India is expected to follow the trend in 2025; however, we expect a shallow cycle.

Source: Trading Economics

India’s 10-year yields dropped by 40 bps through 2024 in anticipation of a rate cut, but not without volatility, as can be seen in the graph below. We preferred accrual over duration and initiated allocations in performing credit AIFs as opportunities opened up as Banks, NBFCs, and Mutual funds vacated the space due to regulatory restrictions and market dynamics.

Source: Trading Economics

Gold experienced a remarkable surge in 2024, driven by a combination of geopolitical tensions, inflation concerns, and central bank buying. The price of gold started the year at around $2,063.73 per ounce and has seen significant gains, reaching highs of approximately $2,748.91 per ounce. We had Gold in client portfolios as a growth asset and held on to the positions throughout the year adding significantly to portfolio returns.

Silver often benefits from the same economic and geopolitical factors that drive gold prices. We have been keenly tracking this commodity as its price is supported by its industrial demand with technological advances and renewable energy and its role as a safe-haven asset. The short supply of silver is expected to keep prices up going forward but with heightened volatility.

Source: Trading Economics

The market review report for the year 2024 offered valuable lessons in navigating market complexities and highlighted the importance of agility in investment strategies. From the outperformance of smaller market caps and thematic sectors to the volatility in fixed income and the resilience of precious metals, the year underscored the need for a well-rounded approach to portfolio management. As we step into 2025, staying attuned to macroeconomic shifts, earnings trajectories, and sectoral opportunities will remain key to balancing growth and protection for our clients’ portfolios. At Entrust, our focus remains unwavering—building resilient portfolios that thrive in an ever-changing world.

In recent years, the global investing conversation has tilted in favor of passive investment strategies—low-cost index funds that track broader markets without attempting to outperform them. However, in the Indian context, active portfolio management still holds compelling merit, particularly in the current market environment. At Entrust, our Investment Advisory team continues to closely monitor and […]

Marriage is often considered a sacred institution in India, deeply rooted in tradition and societal values. Unlike in many other countries where prenuptial agreements (prenups) are legally binding contracts that outline financial and asset-related arrangements in the event of a separation, the Indian legal system does not formally recognize such agreements

Background Some of our clientele include prominent Single-Family Offices (SFOs) managing diverse assets across different geographical locations. These clients usually have distinct entities operating under their umbrella and require a comprehensive tax advisory service to optimize their tax liabilities and achieve significant savings while ensuring legal compliance. The objective for such clients is mostly to […]

signup for updates