Investment Advisory

Investment Advisory

In today’s unpredictable financial markets, factors such as geopolitical tensions and global health crises can create uncertainty and significant fluctuations. This can impact wealth management strategies and lead to emotional decision-making. Understanding the importance of wealth management is crucial during such times. Diversification is an effective strategy for reducing overall risk exposure. During market volatility, it’s important to take a proactive approach to risk management, make strategic asset allocations, and stay informed and adaptable. Key aspects to consider in these circumstances include asset allocation, investment horizon, opportunities, cash flow, and financial goals.

Regularly review and rebalance portfolios to align with long-term goals and risk tolerance. Diversification involves distributing the portfolio among asset classes based on risk tolerance, investment goals, and time horizon. Periodically rebalance the portfolio to maintain the desired asset allocation, spreading investments across various asset classes, sectors, and regions to reduce overall risk exposure. This helps stabilize returns by compensating for losses in one part of the portfolio with gains in other parts.

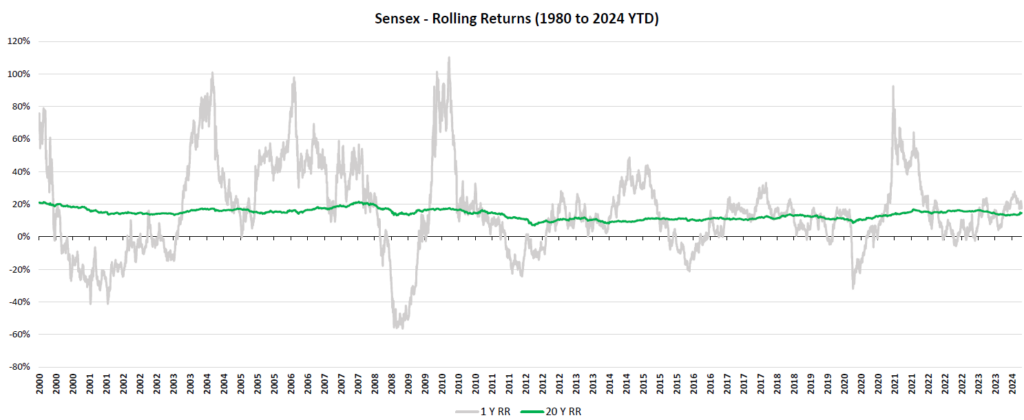

It is important to emphasize the significance of long-term planning and encourage clients to maintain their focus on long-term objectives rather than reacting to short-term market swings. It is crucial to provide guidance and reassurance to help clients adhere to their investment strategies and wealth management strategies. Understanding the importance of wealth management in achieving these goals cannot be overstated. Disciplined investing should be promoted, and decisions should not be based on short-term market movements. Although it may be tempting to make significant changes to your portfolio during volatile periods, it is essential to maintain a long-term perspective. History has shown that markets tend to recover from downturns, and those who remain invested often fare better than those who attempt to time the market. By staying focused on long-term goals and avoiding emotional decision-making, one can effectively manage market volatility.

Identify and capitalize on investment opportunities that align with the client’s strategy and risk profile. Conduct thorough research before making any investment decisions.

Remember to keep enough cash on hand to cover short-term expenses and avoid being forced to sell assets at the wrong time. You might want to take a more defensive approach to your investments, which could mean putting more of your money into less risky assets like high-quality bonds, cash, or defensive sectors such as utilities or consumer staples. While this approach may limit potential gains, it can also help protect you if the market goes down.

It’s important to regularly review and adjust financial plans to align with changing market conditions and personal circumstances. Navigating market volatility can be challenging, especially for individual investors and companies. A professional financial advisor’s expertise can be valuable in developing tailored strategies to address unique financial situations and risk tolerance. In uncertain times, having a trusted financial partner by your side can make a significant difference in wealth protection and growth.

In recent years, the global investing conversation has tilted in favor of passive investment strategies—low-cost index funds that track broader markets without attempting to outperform them. However, in the Indian context, active portfolio management still holds compelling merit, particularly in the current market environment. At Entrust, our Investment Advisory team continues to closely monitor and […]

Marriage is often considered a sacred institution in India, deeply rooted in tradition and societal values. Unlike in many other countries where prenuptial agreements (prenups) are legally binding contracts that outline financial and asset-related arrangements in the event of a separation, the Indian legal system does not formally recognize such agreements

Background Some of our clientele include prominent Single-Family Offices (SFOs) managing diverse assets across different geographical locations. These clients usually have distinct entities operating under their umbrella and require a comprehensive tax advisory service to optimize their tax liabilities and achieve significant savings while ensuring legal compliance. The objective for such clients is mostly to […]

signup for updates